Excalibur Release

Introducing Excalibur

Primitive is excited to kick this new year off with an early pre-release of our latest product: Excalibur.

Excalibur is a suite of integrated tools that are optimized to make the management of DeFi assets as smooth as possible. This pre-release is to show off the two features that we will be shipping in the Excalibur Beta that is slated to launch during Q1 2024. Yes, it's a desktop app!

Preview

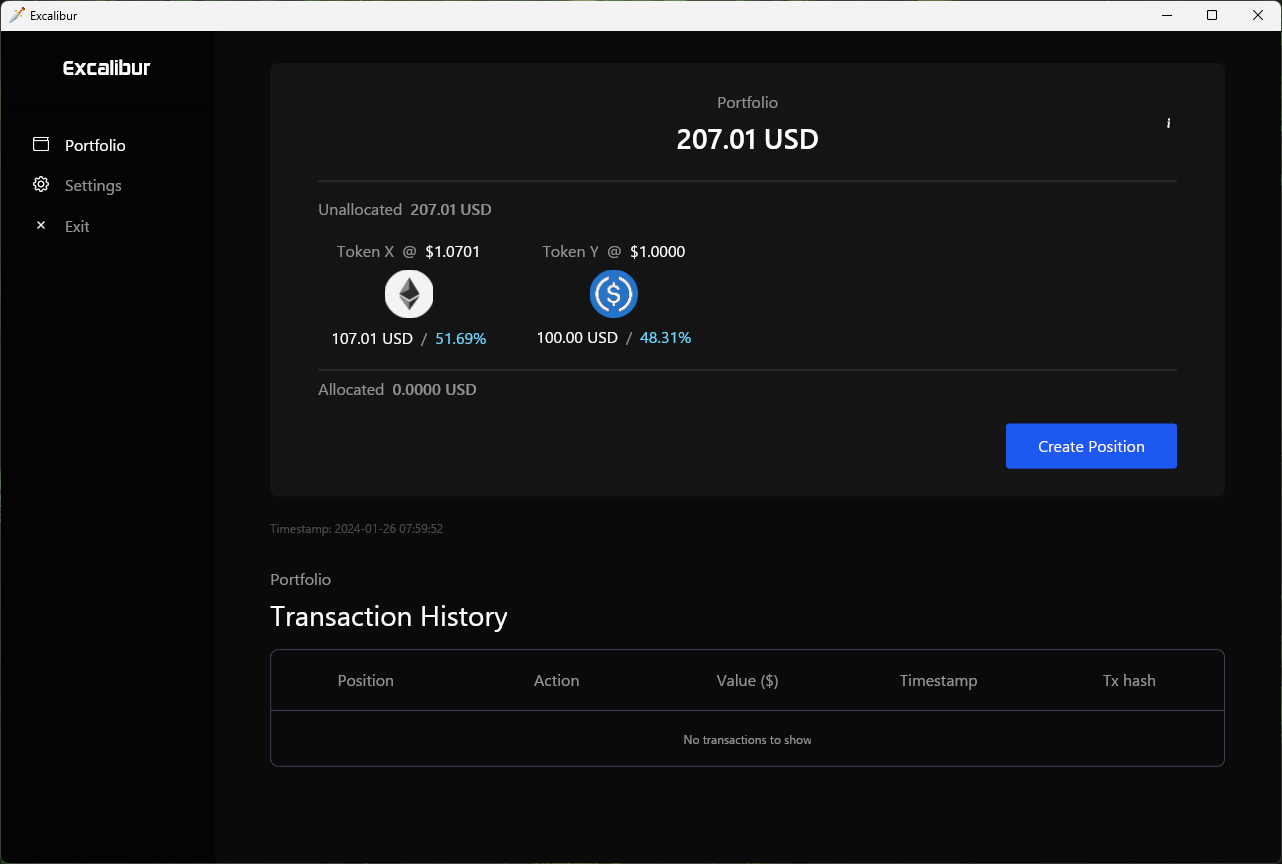

Opening Excalibur is like opening a treasure chest or a vault -- it shows you everything that you value in one place. In this case, it’s the tokens and DeFi positions we own.

Excalibur is not available to download yet.

Two Major Features

Non-custodial Automation

The first feature is a new automated portfolio management solution that remains non-custodial, meaning you and only you are in charge. We’ve been able to balance the trade-offs and make a smart contract protocol that can automate asset rebalancing while keeping you in control of your assets.

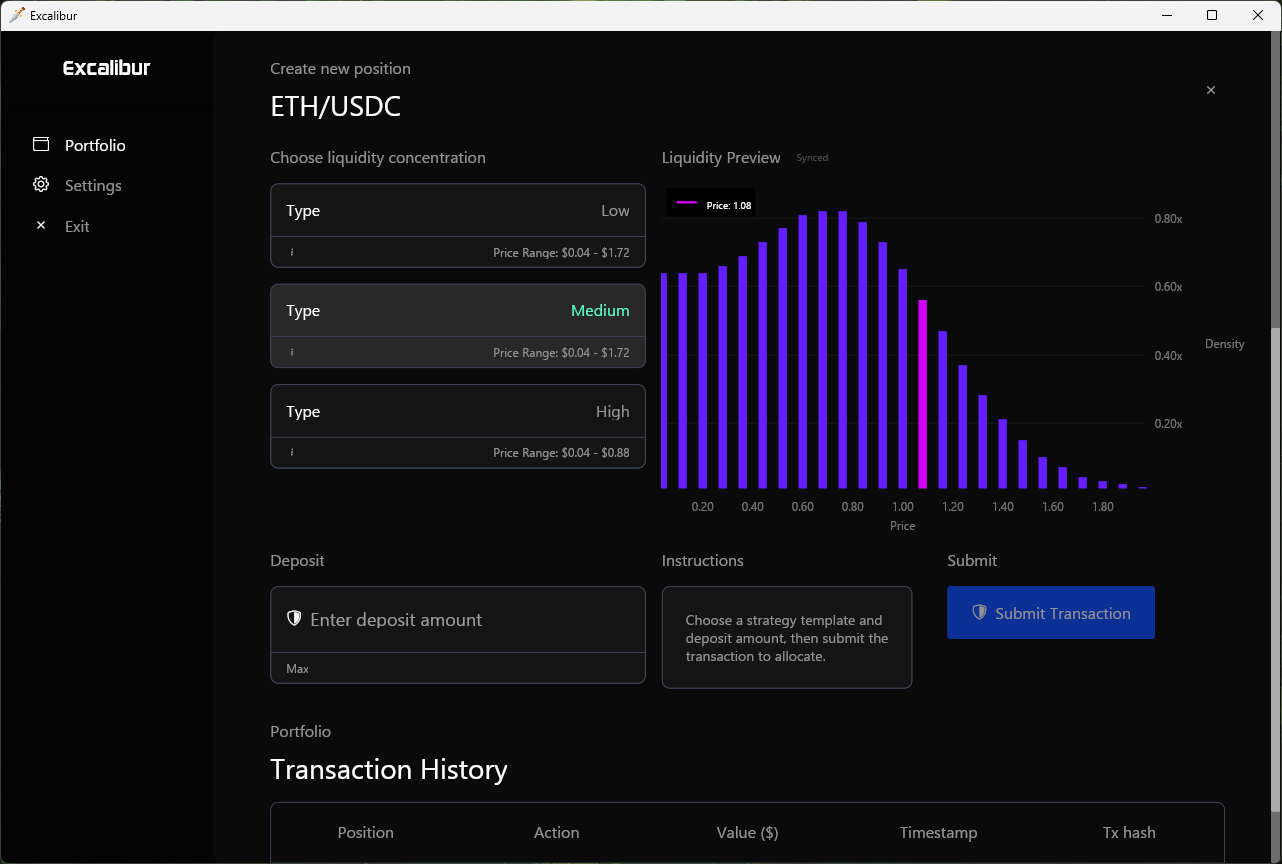

Preview

Choose a template and deposit. Just two steps.

Advanced Transaction Simulation

The second is a ghost environment (Arbiter!) that runs in parallel while you manage your DeFi positions. This simulated environment is capable of seeing transaction outcomes before they are executed and warn you if a potential mistake is being made or an anomaly was detected. More advanced features will be built into this environment so they are capable of simulating scenarios directly in the app.

Think of it this way: Excalibur lets you gain insights with simulated scenarios then allows you to apply it to a live network with a real portfolio using automated portfolio management tech.

The Problem with DeFi

Using DeFi comes with the fear of making a mistake; whether that’s signing a malicious transaction or simply sending tokens to the wrong address. These mistakes are non-reversible, making them potentially catastrophic.

Additionally, DeFi users amass fragmented portfolios across a variety of networks, applications, and wallets. Each of which introduces new risks for a user, new mistakes that can be made, and more headaches to manage. These risks extend beyond just financial risk and also includes the risk of loss from hacks, application failures, or network failures.

Excalibur’s Solution

Hacks are the ultimate fear of every DeFi user, and while Excalibur cannot solve that problem on its own, we are delivering features that can bring some more peace of mind.

Our philosophy is to minimize application complexity and match system complexity with thorough simulation. To accomplish this, Excalibur is built on top of the Arbiter framework which consists of an Ethereum sandbox and agents to provide continual testing of applications.

With Arbiter, we get a new lens into anomalies or bugs before strategies or transactions get executed. It can alert a user if transactions behave in unintended ways and it can let you see what would happen with your portfolio through history or into the future.

Primitive built Arbiter as an open source tool for anyone in the ecosystem to better test their applications and it has already found vulnerabilities that auditing alone had not. All applications inside Excalibur are required to have Arbiter modules so that these simulations can be run and results can be delivered to users.

As for preventing users from making mistakes, Excalibur’s ability to quickly simulate a transaction before it gets sent over the network gives you a better chance of preventing those mistakes. Transaction simulation is a standard feature in many wallets as of today, but we take that a step further by simulating the actors of the protocol via Arbiter. This is increasingly more important as more DeFi protocols are composed together.

Additional Features

Fast Transaction Simulation. See how your transaction will play out before it is sent to a live network in milliseconds. React to results of a transaction before submitting it. Protect and inform yourself on the immediate outcomes of onchain actions.

Portfolio Analysis. Evaluate your portfolio from every angle, across a variety of future onchain market conditions. Project portfolio composition changes over time.

Bring Your Own Wallet. In order for you to transact with a chain, you need to have some type of signer to send valid transactions to an Ethereum network. With Excalibur you can authenticate and sign your transactions securely with Ledger hardware signers.

Manage Networks. Not only do you need a means to sign transactions, you also need a means to send these transactions and receive chain data. Excalibur comes with the capability to allow you to choose your own chain data endpoint, with defaults chosen if you don’t want to handle this complexity.

Coming Next

DeFi Modules. We plan to integrate some other applications and invite other protocols to contribute. We require that any integrated application meets our security standards and has stress-tested its protocol with Arbiter.

Agent Modules. As your strategies grow in complexity, you may need to have some behaviors put in place to automate your trading strategies that may not be able to be solely done onchain. For instance, you may want to have an agent that listens for events that mark the portfolio value of an LP position and closes the position if a given condition is met. Likewise, you may wish to exit a borrowed position if you near liquidation. Even moreso, you can have offchain agents optimize portfolio parameters on your behalf automatically.

Chain Monitor. While your positions are live, you can receive real time updates on activities related to your holdings. This way you can always be informed about their behavior.

Network Security. Most users are unaware of the risks assumed by using third-party Ethereum service providers. Excalibur natively protects users by verifying information integrity and making network related attacks more difficult by giving the user transparency and control when handling their connection to the underlying blockchain.

Live Chain Executor. Simulation is one thing, but we will give users the ability to take these strategies they create and test to a live network. Whether you need to deploy your own contract, or just open a handful of positions, Excalibur will allow you to manage this all from one application.

Backtesting. See how your positions hold up over historical price paths. Backtesting is a valuable technique in strategy evaluation, allowing users to assess the potential profitability and risk of a strategy by applying it to historical data. It offers several advantages, including the ability to gauge performance, refine strategies, understand risks, prevent overfitting, build confidence, and test hypotheses cost-effectively and efficiently.

Forwardtesting. Similarly, see how your positions hold up with models of future price action. You can choose price models to reflect your future beliefs. Want to see how your positions fair in a volatile bull market? Want to see if your positions stay safe during a massive price shock? This type of simulation will let you do so, and hone in your portfolios for the future.

Today

In this release, we open-sourced Excalibur’s code in preparation of the Excalibur Beta launch in Q1 2024. Its feature set is currently constrained in a sandbox environment as we finalize development of the key features described in the post. We are happy to hear any feedback and work with the community in order to get Excalibur into the hands of as many people as we can.

Disclaimer: the Excalibur software is presented as is without any guarantee of any kind.